7 Jan 2025

How Neobank Up Built Its Advantage

Up isn't just another digital bank - it's a glimpse into the future of financial services. While others talk about digital transformation, Up is revolutionising banking in Australia by going all-in on a single idea: a myopic focus on customer experience, powered by technical excellence.

Where Serious Work Flourishes

The first thing you notice about Up is how they've assembled an exceptional team in downtown Melbourne—people who could work anywhere but choose Up. This isn't about perks or startup culture. The attraction is simpler: the opportunity to build technology solutions that matter to customers, working with the brightest minds in the business, in a product-led culture.

Work is orchestrated around missions rather than management structures. Teams form around customer outcomes, bringing together engineers, designers, and product specialists who have the autonomy to solve real problems.

While the customer brand is quirky and fun—the work is serious.

There’s an unmistakable vibe at Up’s downtown Melbourne headquarters that reads as youthful confidence, with a sense of calm and ease that permeates every conversation. But you’d be wrong to mistake this with a naive or lackadaisical approach to banking technology. Far from it. While the customer brand is quirky and fun—the work is serious. Just without the command-and-control structures and procedure-drive culture typically found in banking organisations. Here, people have genuine agency to solve problems. And It's not chaos masquerading as agility either. Security, privacy, governance, and compliance measures are systematically 'baked-in' to every part of the solution with sophisticated technology, and backed-up with a range of sensible defaults about how things happen. All the benefits of well-implemented ‘policy’, just without the bureaucracy and busywork that sometimes goes with it.

Bendigo Bank's has it’s own impressive journey of transformation, and there’s a lot to like about it. They’ve successfully consolidated hundreds of heritage systems into a streamlined technology estate that aims to serve multiple national brands from one digital platform. Bendigo Bank is a century old business that’s been banking since before computers. There’s nothing easy about this mission—bank gets better at technology—while nursing decades-old core banking systems that can never fail. Their progress shows impressive form.

It’s a stark contrast to the possibilities that drive Up: What happens when you start with customer obsession and technical excellence, and add banking capability from there.

Both approaches have merit, and the future likely lies in finding ways to integrate the best of both worlds. It's not easy, but Up's success offers compelling evidence that starting with technology and customer experience can create structural advantages that are hard to replicate.

Long-Term Thinking in Action

Up's approach to building banking capability shows the power of patient, technically-minded execution. Take their customer support platform - while most digital banks are well advised to adopt off-the-shelf solutions, Up invested heavily in building their own system from scratch. This wasn't about being different; it was about having the conviction to build exactly what customers need, even when they’re not asking for it, and don’t know they need it.

This pattern appears throughout Up's history. Rather than adding features to match competitors or chasing growth through traditional channels, they've focused on getting core experiences exactly right. Each investment in technology and customer experience compounds over time, creating advantages that are hard to match by others.

Technical Excellence as Strategy

Up's technology stack represents some of the most sophisticated engineering work in Australian financial services. When we looking for the challenges and scenarios that trips up even the most capable teams, we see an appropriate and well-accepted solution already implemented, or just as often, a unique and frankly brilliant new patterns or solutions that works even better. It’s hard to pick a bone here.

This isn't just good engineering—it's technical excellence deployed as competitive advantage.

What's particularly remarkable is how their technical investments have stood the test of time. Take their support platform—architected six years ago for Up's specific needs—it has proved capable of scaling to support entirely new use cases that couldn’t have been imagined at the time. When the opportunity arose to extend this technology across multiple banking brands, the platform was ready with practically zero refactoring needed. This isn't accident or luck, it's the direct result of technical leadership that thinks in decades, not quarters.

The results speak for themselves. Up's systems deliver bank-grade security, and are built for durability, reliability, and serviceability, all without compromising the rapid iteration cycles and flexibility that is crucial for customer innovation. This isn't just good engineering—it's technical excellence deployed as competitive advantage.

When "Customer-First" Means Something

While "customer-first" has become a corporate cliché, Up's interpretation goes far deeper than most. Every technical decision, every feature, every process is evaluated through the lens of customer experience. This isn't about following customer requests—it's about solving customer problems in ways they might not even imagine possible.

This commitment has proved prescient. Industry skeptics—including me—have long argued that Up's youth-focused brand would struggle to retain customers as they move to more demanding life stages, seeing them abandon the savings and debit products offered by Up as they migrate to credit and home loan products offered by larger banks with the most competitive rates. It’s a reasonable argument. Yet Up is proving the naysayers wrong. Up reached 1 million customers in 2024, and have exceeded their own targets for *Up Home—*the first Home Loan product offered by Up.

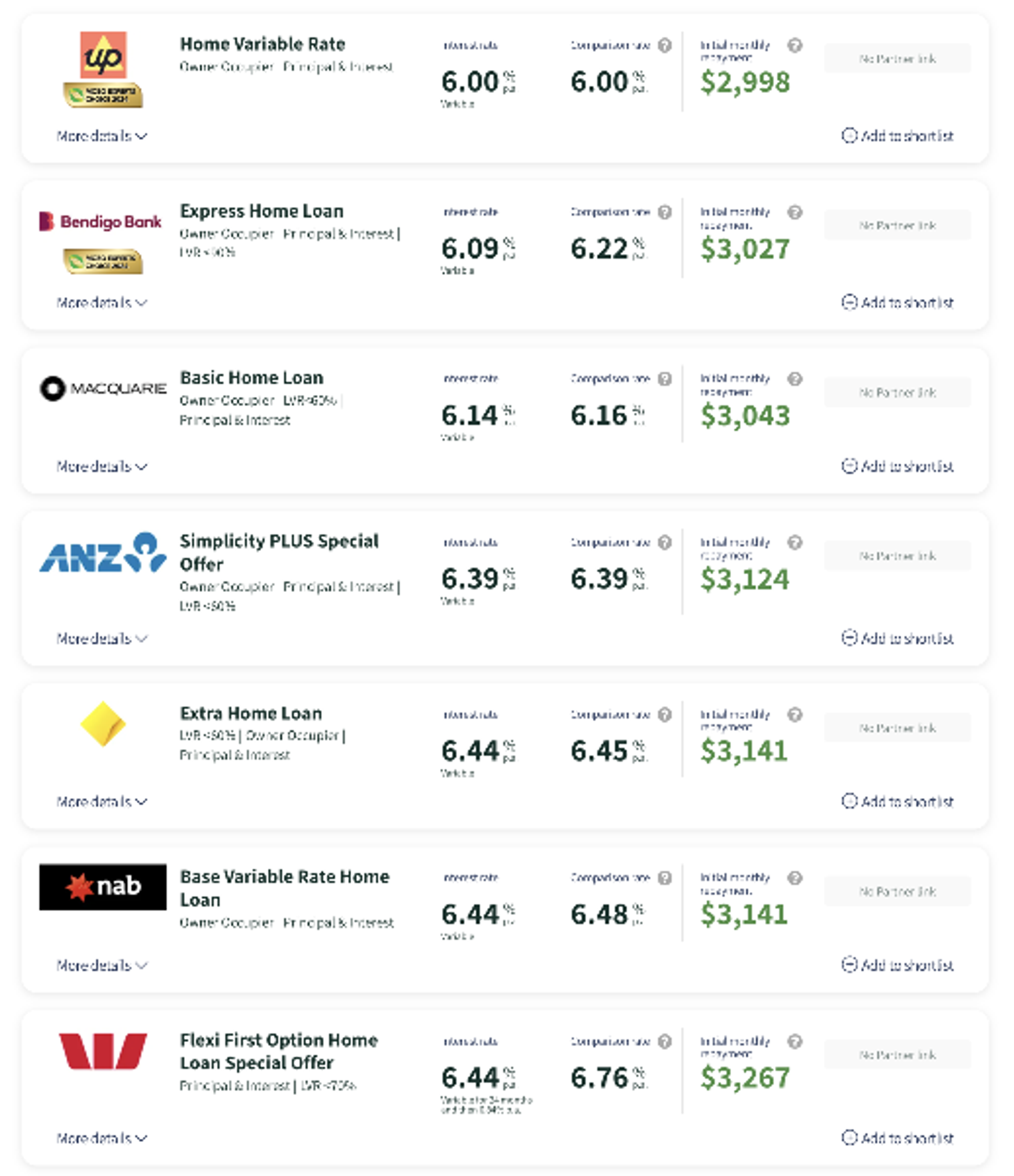

Instead of simply matching traditional mortgage offerings, Up questioned every aspect of the home loan experience, creating a differentiated experience that holds true to the customer-first approach to banking. Now here’s the kicker. The skeptics are probably right to predict customer churn caused by more competitive interest rates offered elsewhere. Except that the Up’s mortgage interest rates are in fact market leading.

Extracted from mozo.com.au, December 2024

How? There are likely a lot of reasons, but I’m willing to bet my underpants that the accumulated technology investments and resulting efficiency of Up’s operating model is a significant factor.

The Future of Financial Services

What Up has built suggests something important about the future of financial services. It's not just about digitising banking processes or making mobile apps. It's about fundamentally reconsidering how banking services can be delivered when you start with technology and unwavering customer focus.

It's about fundamentally reconsidering how banking services can be delivered when you start with technology and unwavering customer focus.

The choices that seemed ambitious in Up's early days—investing heavily in proprietary technology, focusing on experience fundamentals, building for scale while recognising future uncertainty—have matured into structural advantages. Their success with home loans demonstrates how early investments in technology and customer experience create capabilities that extend far beyond basic banking services.

Perhaps most significantly, Up shows that starting with technical excellence and then building banking capability can be more effective than trying to retrofit modern technology onto traditional banking structures. Their ability to maintain customer focus while meeting stringent banking requirements suggests a model for financial services that's both more efficient and more human.

Power Up

The power lies in how Up’s choices reinforce each other. Their focus on technical excellence attracts exceptional talent. This talent, organised into mission-oriented teams, deliver exceptional products. These products create genuine customer value an advocacy, which fuels efficient growth. And their accumulated technology investments translate into structural cost advantages that benefit customers through better rates and services. It’s a virtuous cycle.

Most importantly, Up shows what's possible when organisations fully commit to their convictions. While many companies talk about digital transformation, Up demonstrates that starting with technology and customer-centric thinking—then patiently building industry capability—might be the superior path.

The future of banking might not be about banks becoming more technical, or technology companies pretending to be banks. It's about finding ways to bring the best of both worlds together.

The future of banking might not be about banks becoming more technical, or technology companies pretending to be banks. It's about finding ways to bring the best of both worlds together. Up isn't just showing us how - they've built the technical foundations to make it possible.